Here’s a great example of how to grow a day trading account!

On August 2, 2021, Daryl opened a $28k account and grew it to over $98k by August 12 — just 9 days of trading. And, mind you, this all happened during a time of year (summer) when volume is extremely low, and this summer 2021 is certainly no exception. In fact, the market has been virtually sideways, which is about the most difficult time to find opportunities to make money in the market. But Daryl did.

If you’re a MAX Volume member, you would have seen it all happen in real-time in our Live Trading Room (and you could have been trading alongside Daryl). But if you don’t yet have that access, we’re going to break down the daily play-by-play to give you a look at how this account grew by $70k in a short 9 days of trading.

Fundamentals of Growing a Day Trading Account

Before we get into the play-by-play, let’s consider some factors that go into achieving this level of success — all of which you’ll see in the daily trades.

First, don’t forget that you won’t win every trade. If you have the knowledge, a solid trading plan and the discipline to follow-through with it, you won’t need to. Instead, you’ll put the odds on your side, just like a casino… at the end of the day, the House ALWAYS wins.

Second, finding good trading opportunities takes patience — and action! Daryl’s biggest win over these 9 days came from a setup that was being watched for several days prior to the actual trade. And when the time came to act, it happened quickly. The lesson? Be patient, be confident, and be ready to act.

Third, know your limits. Be comfortable with a certain level of risk and never risk more than you can afford to lose. Likewise, be comfortable with a certain level of return and never let greed wipe out your gains — know when to get out of the trade and be happy with the win since they all add up in the end!

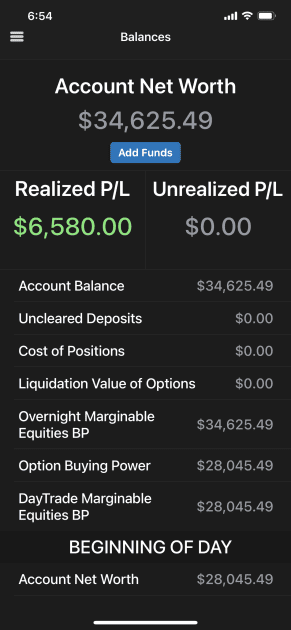

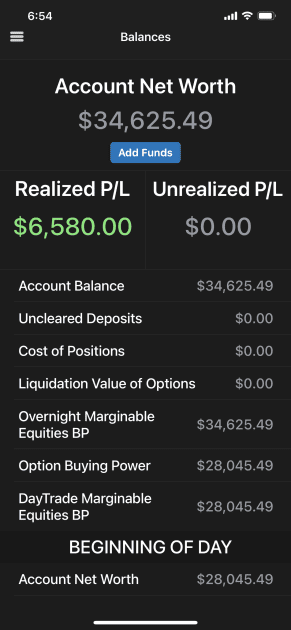

DAY 1: August 2, 2021

Starting Balance: $28,045.49

Ending Balance: $34,625.49

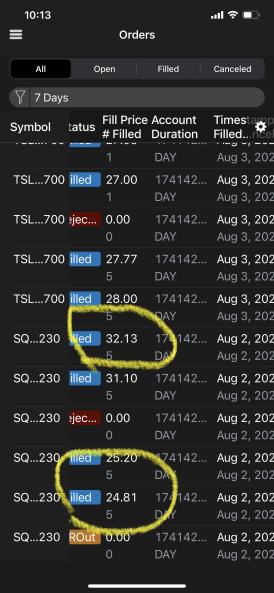

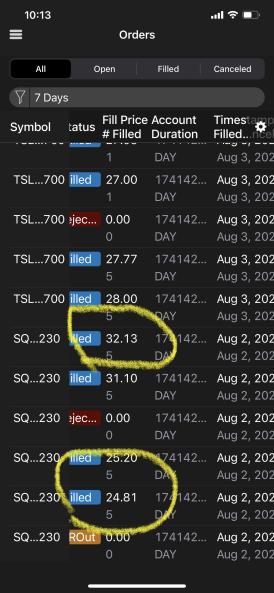

Daryl started this account at just over $28k and made his first trades on Monday August 2 for a gain of $6,580 in SQ (Square, Inc.) – buying at $24.81 and $25.20 and selling at $31.10 and $32.13… account balance at the end of the day: $34,625.49

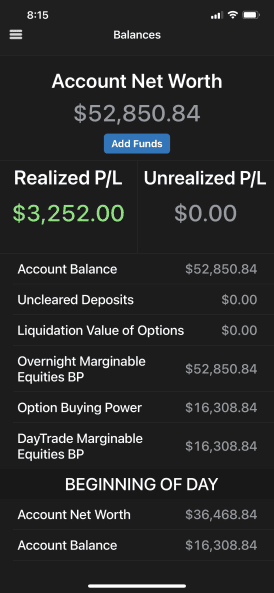

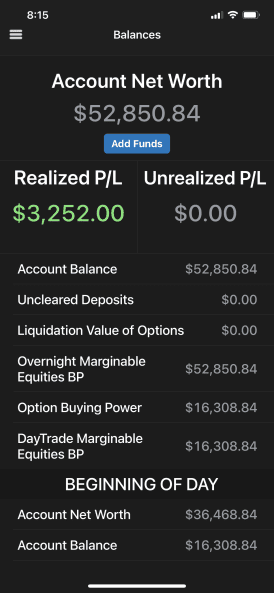

DAYS 2-3: August 3-4, 2021

Ending Balance: $52,850.84

These days are built on several small trades — brick by brick. By end of day Wednesday, the account size jumped to $52,850.84 with some quick trades, the most notable being this $3,252 gain from a TSLA trade. A nice start to growing this day trading account!

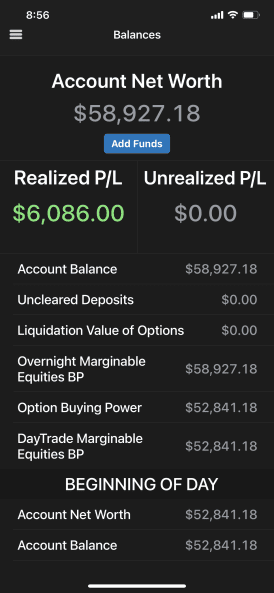

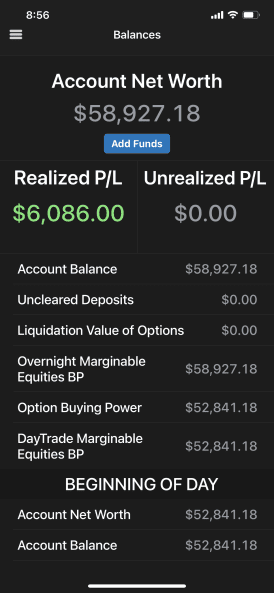

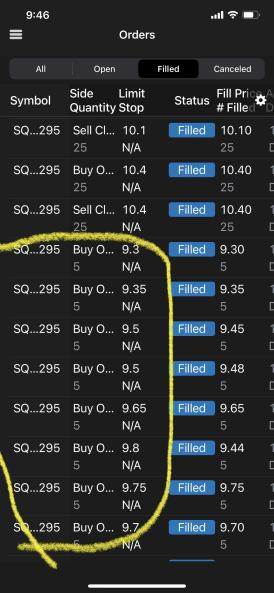

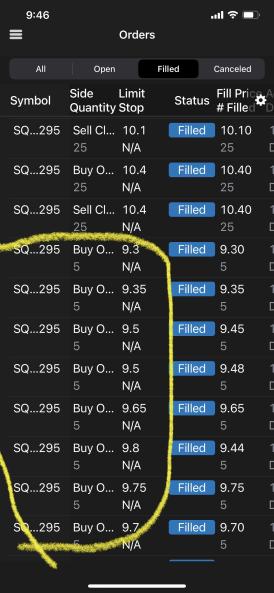

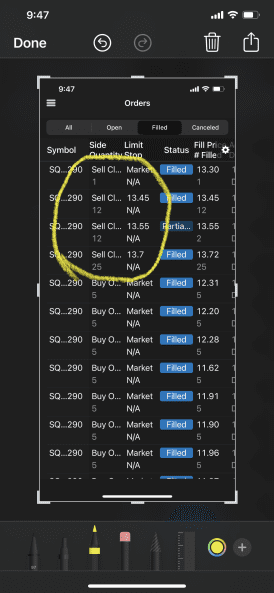

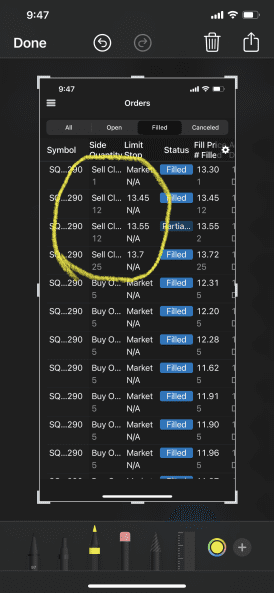

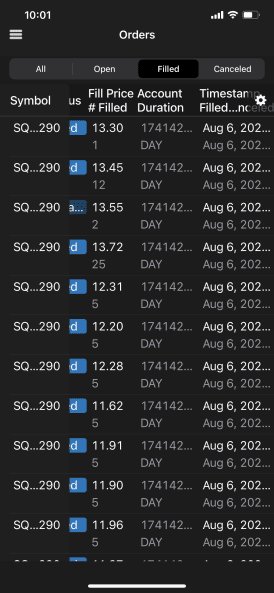

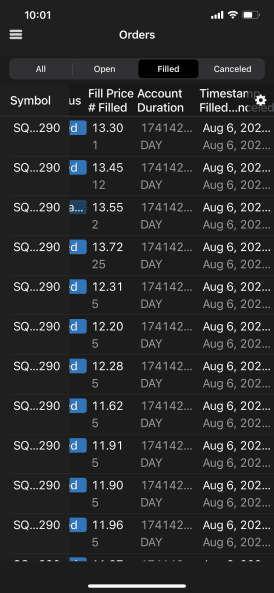

DAY 4: August 5, 2021

Ending Balance: $58,927.18

SQ (Square Inc.) when “parabolic up” where there is a high probability of coming back down to the 21EMA line. Daryl caught the wave, buying at around $9.45 and selling at $13.45 for a gain of $6,086.

Buying:

Selling:

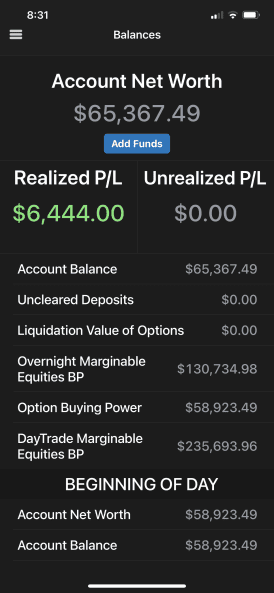

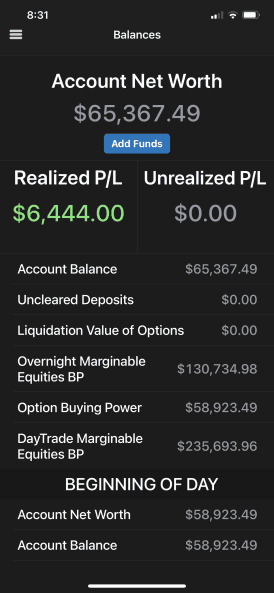

DAY 5: August 6, 2021

Ending Balance: $65,367.49

Friday was another trade with SQ (Square), where the Evening Star pattern revealed an opportunity and the stock hit the resistance on the daily chart… the outcome? A gain of $6,444.

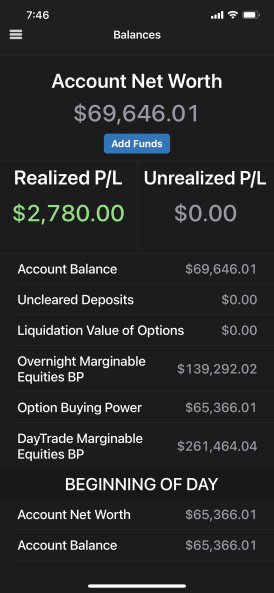

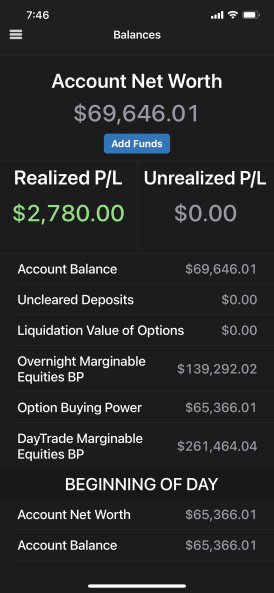

DAY 6: August 9, 2021

Ending Balance: $69,646.01

After just 4 minutes of trading in TSLA (Tesla) at the market open, put options yielded a $2,780 profit as the stock fell from its open price.

DAY 7: August 10, 2021

Ending Balance: $66,585.01

Today was a small down day with a $3,061 loss. You can’t win them all, but you CAN limit your losses with a good trading plan! After seeing TSLA holding the support level from August 9, Daryl added to the positions and held over night.

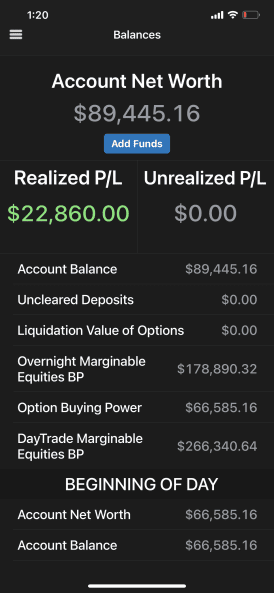

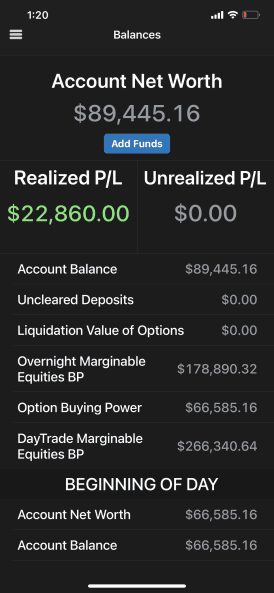

DAY 8: August 11, 2021

Ending Balance: $89,445.15

Today was a big day trading MRNA (Moderna, Inc.), but it actually started back on Sunday August 8 when Daryl recognized an opportunity… Moderna was setting up for a put position!

In the three weeks prior, the stock had jumped from $230 to $491. The ATR (Average True Range) indicator showed the stock was extending upward at a whopping three times the average daily rate. In cases like this, it’s highly likely the price is going to come down toward the 21 EMA line (which was at $365). Being so far above that point, the likelihood of a reversal was strong. And that happened on August 11.

When Daryl saw the price drop below the previous day’s close, and there was good volume in trading, it was time to make a move. After determining his position size and risk tolerance going into the trade, 15 option contracts and $4,500 at risk yielded a return of $21,801.00. Then two more contracts yielded another $1,000 in profits trading the stock back up from its bottom.

The outcome was a profit for the day of $22,860.

DAY 9: August 12, 2021

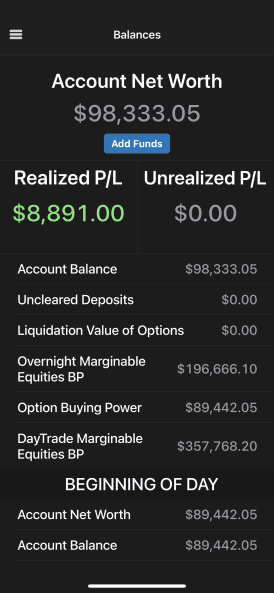

Ending Balance: $98,333.05

More action with MRNA (Moderna Inc.) today! The market opened with a big gap up from yesterday’s close. But the price didn’t hold at $400… and it didn’t hold at 50% of the gap. Good time for puts! Ultimately the price fell to just below the target $380 support level. That’s the point where the stock had been pivoting three times before.

The outcome: an $8,891.00 gain catching the drop in just 5 minutes with just 6 option contracts.

So as you can see, substantially growing a day trading account can be done fairly quickly with the patience to recognize opportunities, taking trades that fit with your trading plan, and trusting your experience and tools.