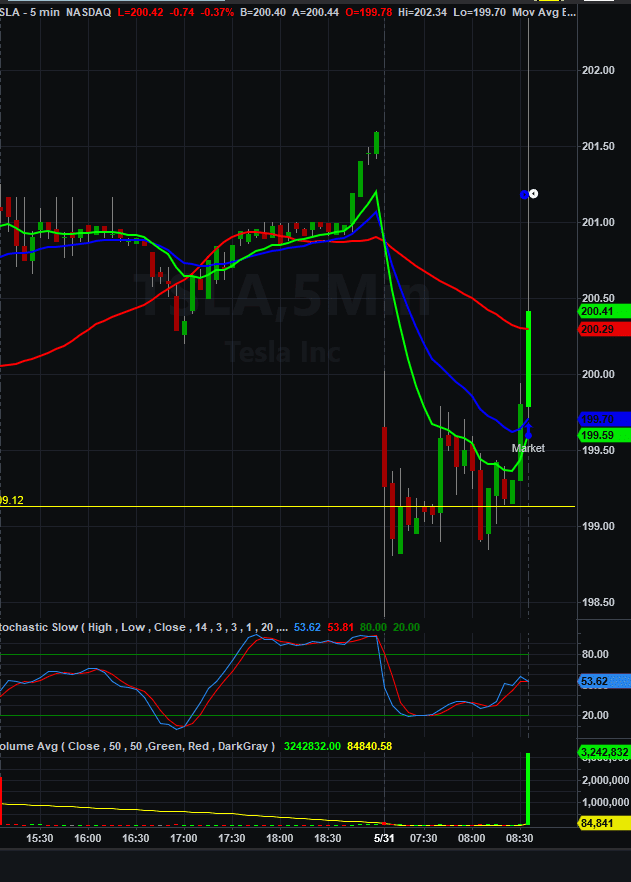

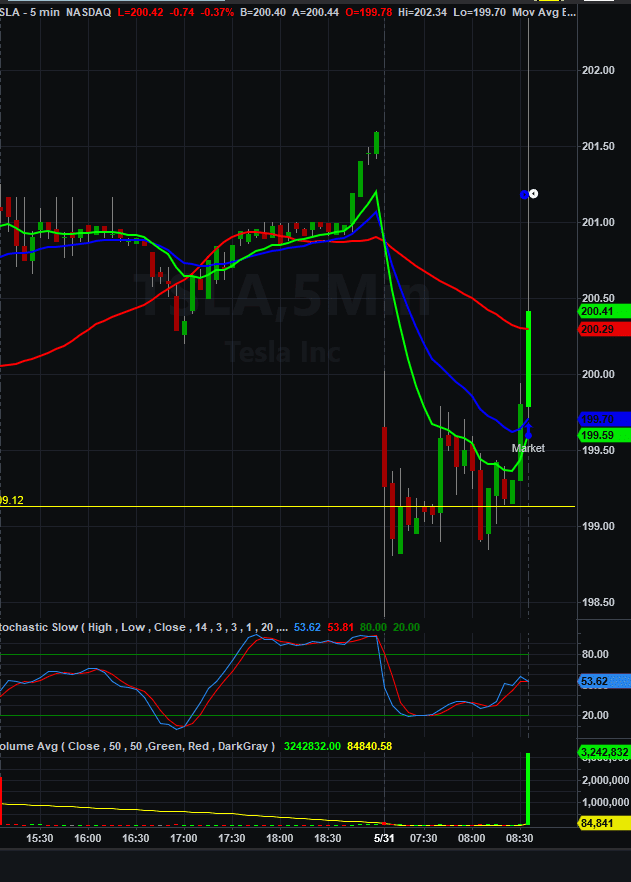

When there’s a price gap overnight in the market, the price will often recover at the open and this can be a high probability trade – depending on the size of the $TICK. When the $TICK is really high and pushing in the opposite direction of the price gap, taking a trade that fills the gap is a type of pattern day trading called a Gap Play. Keep reading this post to learn how to use the $TICK for the best advantage with this type of set up.

The $TICK is an indicator that measures how many stocks are downTICKing vs. upTICKing.

When the $TICK is between +500 and -500, there is no advantage in direction. Every now and then however, the $TICK will extend past the +1000 and -1000 levels. These are considered extreme readings for the $TICK and the market can generally not sustain these levels for long. Typically, when the $TICK hits above these levels, we see a reversal (1).

Often you can predict how big the $TICK is by looking at the futures on CNBC. If the DOW is up/down 150+, SP up/down 50+ and NAS up/down 100+, chances are high the $TICK will be +/-1400+. When the $TICK is +/-1500+ and in the opposite direction of the gap, this is an 80% high probability trade.

There are also numerous other factors to consider that can influence the price direction at open, so it’s important to not only go by the $TICK to make your trade decision. Just to name a few, these include the direction of the Q’s, SPY, watchlist, overall market, volume, etc.). For example, the market can be so strong in one direction, the $TICK doesn’t influence it and the gap doesn’t get filled right away or at all.

This is the type of information we cover in our Limitless Volume Day Trading Course and but you can also often see this trade live in action in our day trading chat room. You’re invited! Click here for a FREE, no obligation, 7-day pass to our live trading room and 1st lesson sample of our course curriculum.

1. Limitless Volume course curriculum, Level 1, lesson 3.